Struggling smartphone pioneer BlackBerry says it has tentatively accepted an offer to be bought out — but until the deal is sealed in November, it is still keeping its options open. The Waterloo, Canada based company said Monday that it has entered into a $4.7 billion agreement to be bought by a consortium led by major BlackBerry shareholder Fairfax Financial Holdings.

If the deal goes through, all other shareholders would receive $9 a share in cash, a slight premium to the $8.23 that the stock is currently trading at. If you think that’s crazy low for what was once a leading technology company, you’re right. BlackBerry’s stock has nose dived by 94 percent over the past five years, from a high of almost $145 in 2008.

If the deal goes through, all other shareholders would receive $9 a share in cash, a slight premium to the $8.23 that the stock is currently trading at. If you think that’s crazy low for what was once a leading technology company, you’re right. BlackBerry’s stock has nose dived by 94 percent over the past five years, from a high of almost $145 in 2008.

Last Friday, BlackBerry announced it will lay off 4,500 employees — around 40 percent of its workforce — and retreat from the consumer market in order to focus primarily on enterprise services. That unexpected news came as part of BlackBerry’s early earnings guidance release, in which the struggling company revealed it expects losses of almost $1 billion in the most recent quarter.

Over the past three years, BlackBerry has seen its market share being eaten away by the growing popularity of touchscreen devices from Apple, Samsung and others. BlackBerry has tried and failed several times to save itself: in 2008 it introduced its own touchscreen phone, the poorly-received BlackBerry Storm; in early 2011 it entered the tablet market with the PlayBook; in 2012 its longtime co-CEOs left and current CEO Thorsten Heins stepped in to make drastic cuts; and this year the company released its Z10 and Q10 phones with the new BlackBerry 10 OS, built from scratch. Sales for both phones have been so disappointing that the company hasn’t revealed recent sales figures. And now the company is trying again with its just-announced Z30 (pictured), which beats the Z10 in both specs and size.

Over the past three years, BlackBerry has seen its market share being eaten away by the growing popularity of touchscreen devices from Apple, Samsung and others. BlackBerry has tried and failed several times to save itself: in 2008 it introduced its own touchscreen phone, the poorly-received BlackBerry Storm; in early 2011 it entered the tablet market with the PlayBook; in 2012 its longtime co-CEOs left and current CEO Thorsten Heins stepped in to make drastic cuts; and this year the company released its Z10 and Q10 phones with the new BlackBerry 10 OS, built from scratch. Sales for both phones have been so disappointing that the company hasn’t revealed recent sales figures. And now the company is trying again with its just-announced Z30 (pictured), which beats the Z10 in both specs and size.

Speaking about today’s news, BlackBerry’s Heins said the changes “are difficult, but necessary… Going forward, we plan to refocus our offering on our end-to-end solution of hardware, software and services for enterprises and the productive, professional end user.”

Fairfax says it will contribute its 10 percent stake in BlackBerry to the consortium, which has until November 4 to complete its due diligence of the company’s financial shape. During that time, BlackBerry can consider other offers.

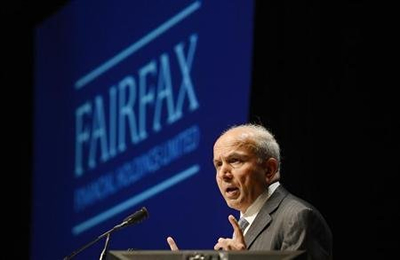

Fairfax CEO Prem Watsa — who has been called the Warren Buffett of Canada — said that the new company “can deliver immediate value to shareholders, while we continue the execution of a long-term strategy in a private company with a focus on delivering superior and secure enterprise solutions to BlackBerry customers around the world.”

Fairfax CEO Prem Watsa — who has been called the Warren Buffett of Canada — said that the new company “can deliver immediate value to shareholders, while we continue the execution of a long-term strategy in a private company with a focus on delivering superior and secure enterprise solutions to BlackBerry customers around the world.”

In its move to focus on what it calls “prosumer” and enterprise-focused devices, BlackBerry plans to cut its smartphone lineup from six to just four devices: two high-end phones, and two entry-level. BlackBerry’s new Z30 is now its new high-end poster child, and the Z10 will be marketed as an entry-level handset to be sold at cheaper prices.

But will cheaper consumer phones and high-end prosumer and enterprise products be enough to win back its previously loyal followers? If BlackBerry can right itself to start innovating again on the high-end side, and keep improving its enterprise server and messaging software to support non-BlackBerry devices, it may be able to win over some newer mobile users who haven’t yet heavily invested in other platforms. Since most of BlackBerry’s future sales will likely be in newer smartphone markets, don’t expect to see the it catching up with Android or iOS in the U.S. anytime soon.