Think you’re paying too much in fees and taxes on your monthly bill for wireless service? You probably are.

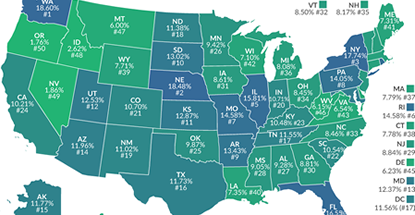

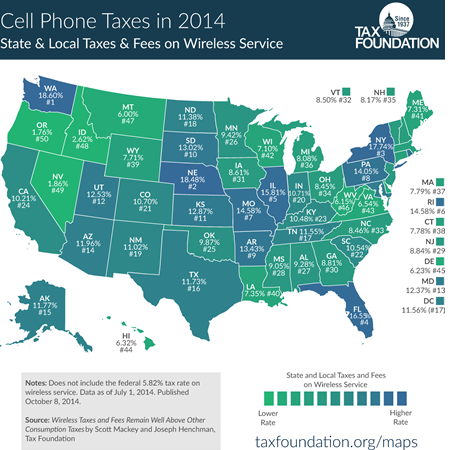

In the United States, mobile device users pay an average of 17.05 percent in combined federal, state, and local taxes and fees on their cellular service bills, according to a new report released today by the nonpartisan Tax Foundation. This rate includes an average 5.82 percent federal rate and an average 11.23 percent state-and-local rate.

The five states with the highest combined state-local rates for cell phone fees and taxes are: Washington State (18.6 percent), Nebraska (18.48 percent), New York (17.74 percent), Florida (16.55 percent), and Illinois (15.81 percent).

The five states with the highest combined state-local rates for cell phone fees and taxes are: Washington State (18.6 percent), Nebraska (18.48 percent), New York (17.74 percent), Florida (16.55 percent), and Illinois (15.81 percent).

The five states with the lowest state-local rates are: Oregon (1.76 percent), Nevada (1.86 percent), Idaho (2.62 percent), Montana (6.00 percent), and West Virginia (6.15 percent).

Four cities — Chicago, Baltimore, Omaha, and New York City — impose effective tax rates in excess of 25 percent of your bill.

States favor higher wireless service taxes because they’re a relatively sneaky way that they can raise revenue without inciting a lot of complaints or bad press. Most of us just seem to take our high cellular service bills for granted.

For example, in 2014, Chicago increased its 911 fee from $2.50 per month per line to $3.90 per month per line (up from $1.25 in 2008), according to the Tax Foundation report. This kind of treatment — coupled with other taxes and fees like its excessive $4 per line fee for general revenue purposes — leaves Chicago consumers with a rate of 35.42% of their total cell phone bill.

Cell phone fees vs. sales taxes

How much higher are your cell phone fees and taxes than your state sales taxes on most other goods and services? On average, more than two times higher, according to the report. And since 2003, overall cellular taxes grew from 15.27 percent to 17.05 percent — about three times faster growth than general sales taxes on other goods and services.

How much higher are your cell phone fees and taxes than your state sales taxes on most other goods and services? On average, more than two times higher, according to the report. And since 2003, overall cellular taxes grew from 15.27 percent to 17.05 percent — about three times faster growth than general sales taxes on other goods and services.

Of course, governments need taxes to raise necessary revenue, but there are some compelling reasons as to why lawmakers should look elsewhere before expanding wireless taxes, fees, and surcharges.

“Wireless taxes and fees are regressive and have a disproportionate impact on poorer citizens,” said Scott Mackey of KSE Partners and co-author of the report. “Excessive taxes and fees may reduce low-income consumers’ access to wireless service at a time when such access is critical to economic success.”

Makey thinks that targeted cell phone fees and taxes might also slow investment in wireless infrastructure by lowering consumer demand for wireless services. “The reduced demand impacts network investment, because subscriber revenues ultimately determine how much carriers can afford to invest in network modernization,” he says.

You can read the full report, “Wireless Taxation in the United States 2014” for free online.