Americans are now spending almost as much on smartphone and tablet entertainment as they spend at the box office. In 2014, mobile entertainment revenue reached $9.14 billion, according to a new report from analyst firm SNL Kagan. That number is fast approaching the roughly $10 billion per year the U.S. box office generates from ticket sales.

The combined mobile entertainment revenue from mobile games, video, music and location-based services (LBS) has grown at a 50% CAGR since 2011, up from $2.71 billion in 2011, according to SNL.

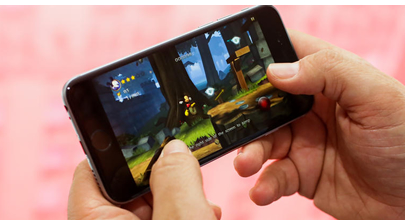

The new era of touch-screen smartphones is a great fit for mobile games. The larger screens, touch capabilities, accelerometers and easy-to-navigate app stores made the pre-iPhone mobile game business of WAP decks and pixelated grey screens feel very distant. The games category has always dominated mobile entertainment revenue, with growth from $1.47 billion in 2011 to over $5 billion in 2014, says SNL. Last year, 57% of all mobile entertainment revenue was from game sales.

The new era of touch-screen smartphones is a great fit for mobile games. The larger screens, touch capabilities, accelerometers and easy-to-navigate app stores made the pre-iPhone mobile game business of WAP decks and pixelated grey screens feel very distant. The games category has always dominated mobile entertainment revenue, with growth from $1.47 billion in 2011 to over $5 billion in 2014, says SNL. Last year, 57% of all mobile entertainment revenue was from game sales.

And today’s new bevy of single-title publishers like Mojang, King and Supercell are finally making the economics of mobile games attractive. Compared to the old overhead-intensive strategy of “throw everything at the wall to see what sticks,” these new entrants are logging EBITDA margins north of 30% on a handful of titles — a commendable feat, given the notoriously lackluster economics of mobile games. (More details on mobile game economics will be available in SNL Kagan’s upcoming “Economics of Mobile Games” report, due for release in early 2015.)

Video is the second-largest mobile entertainment revenue category. Most mobile video revenue is derived not from the carrier-based mobile video subscription services, which have flatlined, but from strong advertising revenue growth and mobile views at sites like Google’s YouTube. In 2014, mobile video generated $1.8 billion in revenue in the U.S., primarily from advertising, estimates SNL Kagan. (You can find more details on mobile video economics in their report, Economics of Mobile Programming.)

Mobile music, the third-largest mobile entertainment revenue generator, is also mid-transition: ringtones are fading while a crescendo is building for subscription streaming and radio services. The U.S. ringtone/ringback business topped nearly $1 billion in its 2008 heyday before shrinking to what SNL estimates is now less than a $50 million per year business.

Mobile music, the third-largest mobile entertainment revenue generator, is also mid-transition: ringtones are fading while a crescendo is building for subscription streaming and radio services. The U.S. ringtone/ringback business topped nearly $1 billion in its 2008 heyday before shrinking to what SNL estimates is now less than a $50 million per year business.

Replacing unfashionable ringtones are subscription-on-demand streaming services from players such as Spotify and online radio services such as Pandora Media’s Pandora Radio, with both companies reporting that the majority of their usage is on mobile devices. In 2014, SNL Kagan estimates mobile music — including ringtones, radio and streaming services — generated about $1.76 billion in the U.S. (You can find more details on the global mobile music space in their report, Economics of Mobile Music.)

Location-aware services remain the smallest piece of the mobile entertainment revenue pie. The startups built upon location-aware services have gone through many re-inventions over the years, including game-based location apps, augmented reality, location-aware dating apps and “check-in” mobile social network services like Foursquare (which itself has transitioned into two distinct services, one of which is chasing after Yelp Inc.’s online reviews turf).

However, SNL thinks advertisers will increasingly require location data for mobile spends and that LBS as a stand-alone service from an app may play second fiddle to the revenue generated from advertisers simply expecting LBS capabilities from all mobile apps and web searches. You can find more details on the location-based services marketplace in SNL Kagan’s Economics of Location-Based Services report.

You can check out detailed charts from this report here, and sign up for a free trial of SNL Kagan’s regular wireless investment report summaries here.