It may have just turned four years old, but Google’s Android is already growing up fast. The operating system is now on three out of every four smartphones shipped during the third quarter of 2012 (3Q12).

It may have just turned four years old, but Google’s Android is already growing up fast. The operating system is now on three out of every four smartphones shipped during the third quarter of 2012 (3Q12).

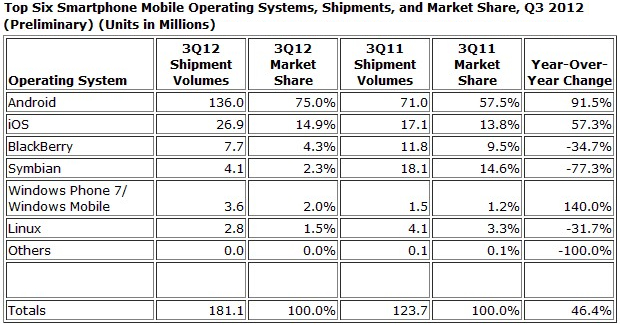

Total Android smartphone shipments worldwide reached 136 million units, accounting for 75 percent of the 181.1 million smartphones shipped in 3Q12. The 91.5% year-over-year growth was nearly double the overall market growth rate of 46.4%, according to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. (See table below).

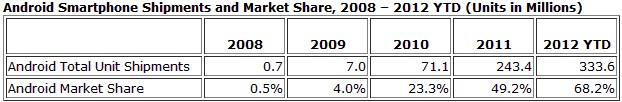

“Android has been one of the primary growth engines of the smartphone market since it was launched in 2008,” says Ramon Llamas, mobile phones research manager at IDC. “In every year since then, Android has effectively outpaced the market and taken market share from the competition.”

“The share decline of smartphone operating systems not named iOS since Android’s introduction isn’t a coincidence,” adds Kevin Restivo, senior research analyst with IDC’s Worldwide Quarterly Mobile Phone Tracker. “The smartphone operating system isn’t an isolated product; it’s a crucial part of a larger technology ecosystem. Google has a thriving, multi-faceted product portfolio. Many of its competitors, with weaker tie-ins to the mobile OS, do not. This factor and others have led to loss of share for competitors with few exceptions.”

Even Apple’s iOS isn’t immune to the growing popularity of Android and to a lesser extent, Windows Phone. A recent Strategy Analytics report found that for the first time since the iPhone was released in 2007, the number of iPhone owners who say they definitely will or probably will purchase their next phone from Apple has declined. According to that study, only 75 percent of iPhone owners in Western Europe say they are likely to make their next phone another iPhone, down from 88 percent in 2011. Repeat purchase intentions among US iPhone owners have also declined slightly, down from 93 percent in 2011 to 88 percent in 2012.

Here are some highlights of the five major mobile operating systems’ 3Q12 market shares, provided by IDC:

Android, having topped the 100 million unit mark last quarter, reached a new record level in a single quarter. By comparison, Android’s total volumes for the quarter were greater than the total number of smartphones shipped in 2007, the year that Android was officially announced. Samsung once again led all vendors in this space, but saw its market share decline as numerous smaller vendors increased their production.

iOS was a distant second place to Android, but was the only other mobile operating system to amass double-digit market share for the quarter. The late quarter launch of the iPhone 5 and lower prices on older models prevented total shipment volumes from slipping to 3Q11 levels. But without a splashy new OS-driven feature like Siri in 2011 and FaceTime in 2010, the iPhone 5 relied on its larger, but not wider, screen and LTE connectivity to drive growth.

BlackBerry has continued its market share slide, falling to just over four percent by the end of the quarter. With the launch of BlackBerry 10 yet to come in 2013, BlackBerry will continue to rely on its aging BlackBerry 7 platform, and equally aging device line-up. Still, demand for BlackBerry and its wildly popular BBM service is strong within multiple key markets worldwide, and the number of subscribers continues to increase.

Symbian posted the largest year-on-year decline of the leading operating systems. Nokia remains the largest vendor still supporting Symbian, along with Japanese vendors Fujitsu, Sharp, and Sony. Each of these vendors is in the midst of transitioning to other operating systems and IDC believes that they will cease shipping Symbian-powered smartphones in 2013. At the same time, the installed base of Symbian users will continue well after the last Symbian smartphone ships.

Windows Phone marked its second anniversary with a total of just 3.6 million units shipped worldwide, fewer than the total number of Symbian units shipped. Even with the backing of multiple smartphone market leaders, Windows Phone has yet to make a significant dent into Android’s and iOS’s collective market share. That could change in 4Q12, when multiple Windows Phone 8 smartphones will reach the market.

Linux volume declined for the third straight quarter as did its year-over-year growth. Samsung accounted for the majority of shipments once again, but like most other vendors competing with Linux-powered smartphones, most of its attention went towards Android instead. Still, that has not deterred other vendors from experimenting, or at least considering the open-source operating system, as multiple reports of Firefox, Sailfish, and Tizen plan to release new Linux-based experiences in the future.

Source: IDC Worldwide Mobile Phone Tracker, November 1, 2012

Note: Data are preliminary and subject to change.

Vendor shipments are branded shipments and exclude OEM sales for all vendors.

For more information, check out IDC’s Worldwide Quarterly Mobile Phone Tracker.